Understanding the frustrations

EXtrance CEO William Lively is an investor, an innovator, and a technologist at heart. In the past, he was offered opportunities in various limited partnerships. Through those experiences, William identified pervasive problems and archaic systems that really burdened the investment space and his appetite to invest.

One of the lesser discussed aspects of Limited Partnership investing is what occurs when “you need to get out” of the investment or cannot fund capital calls. LP agreements will have dilution clauses, yet typically do not have buy/sell provisions. Monetizing a position can be cumbersome given regulatory issues and the small pool of replacement investors from which to solicit. The liquidating LP may very well not attain its fair market value because of these factors. William saw the potential for a technology-based solution within this particular space. By taking his success running a start-up, understanding of blockchain, and expertise to create a system architecture, he sought to bring it all together in a single source solution.

Solving problems

An understanding of both the latest technology and the needs of investors inspired William to bring together the right team to solve the challenges of an industry that can often be slow to embrace change. Managing investments is complex. Accurate reporting is vital. Investment structures are fixed. Secure transactions and communications are not optional. It’s time to move this industry forward.

Bringing Investment Management Into This Century

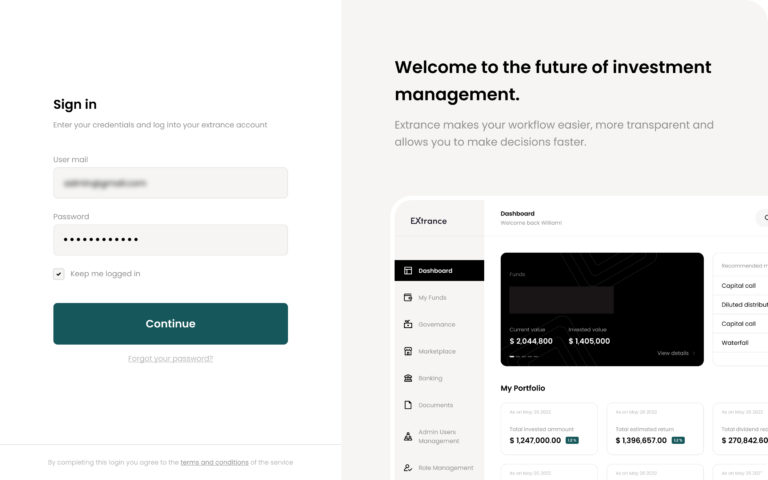

The EXtrance platform is built to transform the way investments are managed by using next-generation technologies, including blockchain integration, AI, and machine learning. Not sure what those are? That’s OK—we know. And we’re putting them to work for you. Let our powerhouse platform expose overlooked efficiencies and opportunities to automate even complex processes. We’ll build you an easy-to-use dashboard based on superior data with limitless querying capabilities to ensure you always have the information you need at your fingertips. And you can be up and running in weeks, not months.

Customizing your functional investor profile

EXtrance goes beyond your basic investor portal. It also offers investors liquidity through a marketplace of well-qualified, exclusive institutional managers. Access to this pool of limited partners and general partners has never been easier. An individualized Investor Profile not only provides insight into your own data, it also creates the building blocks of the platform’s buy/sell capabilities by ensuring that only qualified matches are presented for consideration.

Your Investor Profile gives insight into your limited partnership and displays crucial information such as:

- Your investment (shares with dollar amount)*

- Assets / Assets performance

- Any direct communications from GP (quarterly investor updates)

- Distribution history and total amount paid out (distributions will be automated for those investors who opt for the service)

- Investment analytics

- Form 1065s

- All investment documentation and records

- When viewing investments, you have the option to trade or sell

Your information remains secure within the blockchain-based CRE ecosystem, allowing you to make crucial decisions, showcase sensitive investment information, and communicate with limited partners for success.

The Greater Vision

The vision for EXtrance is to be the premier investor management service, unlocking the potential for alternative investments to offer more for investors.

EXtrance is an amplifier of best-practice for fund managers, general partners, and managing partners who have been delivering consistent high-quality, risk-adjusted returns for years through relationships, expertise, and often sheer force of effort.

The pain points EXtrance solves are not exclusive to the investors in commercial real estate and will provide relief to venture capital and private equity firms that share similar structures as CRE limited partnerships.

In the future, the EXtrance platform and investor ecosystem’s holistic approach to solving investors’ problems has applications outside of real estate and will allow us to expand and serve more investors in carrying out our vision of solving these problems for all investors facing illiquidity, costly management, and a lack of transparency and security.